- Introduction

- Chapter I - Online System Terminology

- Chapter II - Online Menu Functions Overview

- Chapter III - Navigating the Online System

-

Chapter IV - Inquiries Submenu (01)

- Accessing the Inquiries Submenu

- Beneficiary/CWF (10)

- DRG (Pricer/Grouper) (11)

- Claim Summary (12)

- Revenue Codes (13)

- HCPCS Codes (14)

- DX/Proc Codes ICD-9 (15)

- Adjustment Reason Codes (16)

- Reason Codes (17)

- ZIP Code File (19)

- OSC Repository Inquiry (1A)

- Claim Count Summary (56)

- Home Health Payment Totals (67)

- ANSI Reason Codes (68)

- Invoice Number/DCN Translator (88)

- DX Proc Codes ICD-10 (1B)

- Community Mental Health Centers Services Payment Totals (1C)

- Check History (FI)

- Provider Practice Address Query (1D)

- New HCPCS Screen (1E)

- Opioid Use Disorder (OUD) Demo 99 (1F)

- Chapter V - Claims and Attachments Submenu (02)

- Chapter VI - Claims Correction Submenu (03)

- Chapter VII - Online Reports View Submenu (04)

-

Resources

- Part A Electronic Medicare Secondary and Tertiary Payer Specifications for ANSI Inbound Claim

- Electronic Medicare Secondary Payer Specifications for Inbound Claims

- FISS UB-04 Data Entry Payer Codes

- Common Claim Status/Locations

- FISS Reason Code Overview

- FISS Reason Code/Claim Driver Overview

- Program Function/Escape Key Crosswalk

- How to Adjust a Claim

- FISS Claim Change/Condition Reason Codes

- How to Cancel a Claim

- How to Correct a Return to Provider Claim

- Online System Menu Quick-Reference

Chapter IV: Inquiries Submenu (01)

Revenue Codes (13)

Purpose

The purpose of the REVENUE CODES option is to provide access to details related to the revenue codes available to be reported on a claim.

A revenue code is a four-digit number that identifies where the patient was when they received treatment, and what type of item/service a patient received.

Note: All revenue codes listed in the REVENUE CODES option match the FISS editing files. Claims submitted that do not correspond with the data contained within the revenue code option will be RTP.

To access the REVENUE CODES option from the FISS online system INQUIRES submenu, type ‘13’ at the Enter Menu Selection: prompt, then press <Enter>.

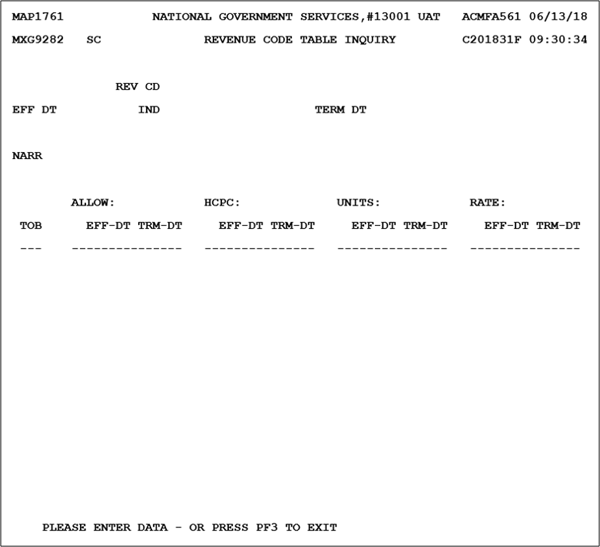

Upon selecting the REVENUE CODES option, the initial REVENUE CODE TABLE INQUIRY screen is available:

To access revenue code data, type the four-digit revenue code you wish to research in the REV CD field, then press <Enter>.

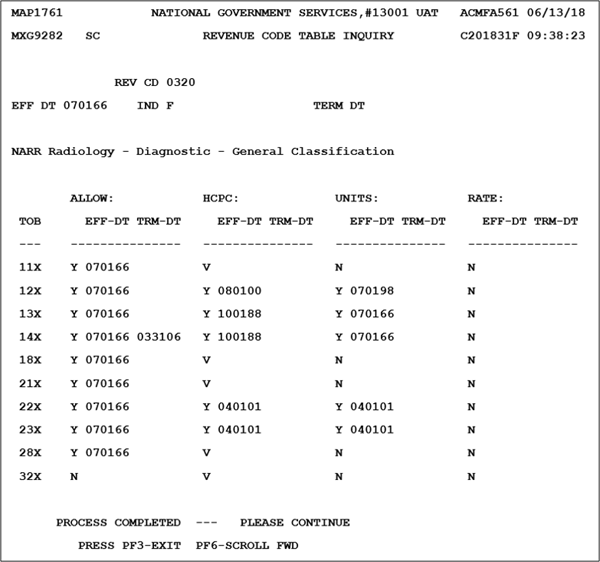

The Revenue Code Table Inquiry screen is updated to provide the revenue code details. As an example, the results of an inquiry for revenue code 0320 is shown:

| Field | Discription |

|---|---|

| REV CD | Revenue code– Identifies the location/type of service that is being billed for Medicare reimbursement (four-position alphanumeric field) Valid values 0001–9999 |

| EFF DT | Effective date– Identifies the date this revenue code became effective (six-position alphanumeric field in MMDDYY format) |

| IND | Effective date indicator– The effective indicator instructs the system to either use the FROM date on the claim or to use the system run date to perform edits for this particular revenue code (one-position alphanumeric field) Valid values F = Claim from date R = Claim receipt date D = Claim discharge date |

| TERM DT | Termination date– Identifies the date this revenue code became invalid (six-position alphanumeric field in MMDDYY format) |

| NARR | Narrative– Identifies the description or narrative for the revenue code (70-position alphanumeric field) |

| TOB | Type of bill– Identifies the type of facility, bill classification, and frequency of the claim in a particular period of care (three-position alphanumeric field) |

| ALLOW: EFF-DT TRM-DT | Allowable– Identifies whether or not this revenue code is currently valid (one-position alphanumeric field) Valid values Y = Yes N = No If Y is indicated, the revenue code is allowable for the bill type. Effective date is indicated if a Y is present, as well as a termination date, if applicable. |

| HCPCS: EFF-DT TRM-DT | HCPCS Code – Indicates whether the revenue code requires a HCPCS code. Valid values Y = Required N = Not required V = Verify valid HCPCS code If Y is indicated, then effective date is indicated as well as a termination date, if applicable. If V is indicated, then the system will verify that the HCPCS entered on the claim is a valid HCPCS per the HCPCS file, but will not require a HCPCS to be entered in order to process the claim. |

| UNITS: EFF-DT TRM-DT | Units – Indicates whether units are required for the bill type. Valid values Y = Required N = Not required If Y, then effective date is indicated as well as a termination date, if applicable. |

| RATE: EFF-DT TRM-DT | Rate – Indicates whether the revenue code requires a rate to be billed. Valid values Y = Required N = Not required If Y, then effective date is indicated as well as a termination date, if applicable. |

Additional bill types can be accessed by using the <PF/F6> key to scroll forward.

Please note: NUBC maintains the revenue code tables. Contact the NUBC for a subscription.

Revised 8/16/2023