Remittance Advice

Table of Contents

General Information

Once Medicare has processed a claim, the provider will receive a notice referred to as a remittance advice.

There are two types of RAs:

- SPR

- ERA

The RA may include the following information:

- Patient name

- Patient HICN

- Rendering provider’s name

- Dates of service

- Type of service, procedure codes, and modifiers

- Charges (submitted, allowed)

- Payment, including any deductions (and copayments)

- Reason and/or remark codes

- Indication your claim has been forwarded to the supplemental carrier for processing

Electronic Remittance Advice

This is the preferred method for a provider to receive their RA. There are many benefits to receiving an ERA such as:

- Eliminates mail time

- Same information as the paper remittance plus line-level detail as well as noncovered detail

- Includes all reason and remark codes applicable to the claim

- Allows for creation of ad hoc reports (if supported by your software application)

- Allows for automated posting (if supported by your software application)

Remittance Message Codes

CMS has developed a system of message codes that National Government Services must use to describe how we adjudicated a claim. There are three different types of codes used:

- MOA codes

- ANSI group codes

- Medicare reference remark codes (REF)

Each of these codes will give you specific information about each claim. Visit the Washington Publishing Company website for a complete listing of these codes. The codes will be discussed in the order they appear on the SPR.

Medicare Outpatient Adjudication Codes

Medicare MOA remark codes are used to convey appeal information and other claim specific information that does not involve a financial adjustment. An appropriate appeal, limitation of liability, or other message must be used whenever applicable.

ANSI Group Codes

An ANSI group code is always shown with each ANSI reason code to indicate when you may or may not bill a beneficiary for the non-paid balance of the service or equipment you furnished.

Valid group code values are:

| Code | Definition/Description |

|---|---|

| CO | Contractual obligation: Payment adjustment where the provider did not meet a payer-determined program requirement and is always financially liable. You may not hold a beneficiary financially responsible for any adjustments identified with group code CO. CO is always used to identify excess amounts for which the law prohibits Medicare payment and absolves the beneficiary of any financial liability, such as participation agreement violation amounts, limiting charge violations, late filing penalties, or amounts for services not considered to be reasonable and necessary. |

| CR | Correction or reversal of a prior decision: Change to previously processed claim. This does not express liability. |

| OA | Other adjustment: Any other adjustment. Does not include any adjustment of which the patient or provider has financial liability. Group code OA will be used when neither PR nor CO applies, such as with reason code message that indicates the bill is being paid in full. |

| PR | Patient responsibility: Any adjustment where the patient has assumed or will be assuming financial responsibility. All denials or reductions from your billed amount that show group code PR are the financial responsibility of the beneficiary or his/her supplemental insurer (if it covers the service). Due to their frequency of use, separate columns have been set aside for reporting of deductible and coinsurance, both of which are totaled in the patient responsibility field at the end of the each claim. If you already collected an amount from the beneficiary for this claim in excess of the patient responsibility total prior to receipt of the remittance notice, you are required by law to refund the excess to the beneficiary. |

Reason Codes

Reason codes are used with an ANSI group code to explain the basic reason for a denial or reduction of a claim for service. Reason codes are usually generic for use by any health payer, but remark codes can be more specific to the policy of a particular payer.

Remark Codes

Remark codes are used to relay service-specific Medicare informational messages that cannot be expressed with a reason code; they are used to clarify a reason code. A remark code may express a policy or coverage rule for a plan that underlies the decision expressed in the reason code, express appeal rights that accompany the decision expressed in a reason code, or something similar. Remark codes cannot be used by themselves to deny or reduce payment on a claim or service. They can, however, be used for informational purposes.

Requests for Additional Codes

CMS has national responsibility for maintenance of the RARC. Requests for new or changed remark codes should be submitted to CMS via the Washington Publishing Company Remittance Advice Remark Codes website. Requests for codes must include the name, phone number, company name, and email address of the requestor, the suggested wording for the new or revised message, the associated reason code to be used, and a business justification of how the message will be used and why it is needed. A fax number or mail address is acceptable in the absence of email. Requests may also be mailed to:

Attn: Sumita Sen

Centers for Medicare & Medicaid Services

OIS/BSOG/DDIS

Mail Stop N2-13-16

7500 Security Boulevard

Baltimore, MD 21244-1850

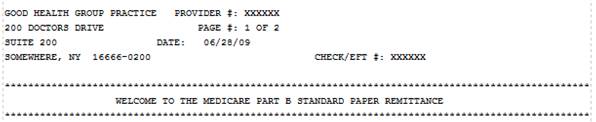

Standard Paper Remittance

As part of CMS' continuing effort to eliminate variations in the administration of Medicare across the country and to furnish a uniform level of information to all providers of health care about the decisions made on their claims, the look and content of paper remittance advice notices was standardized.

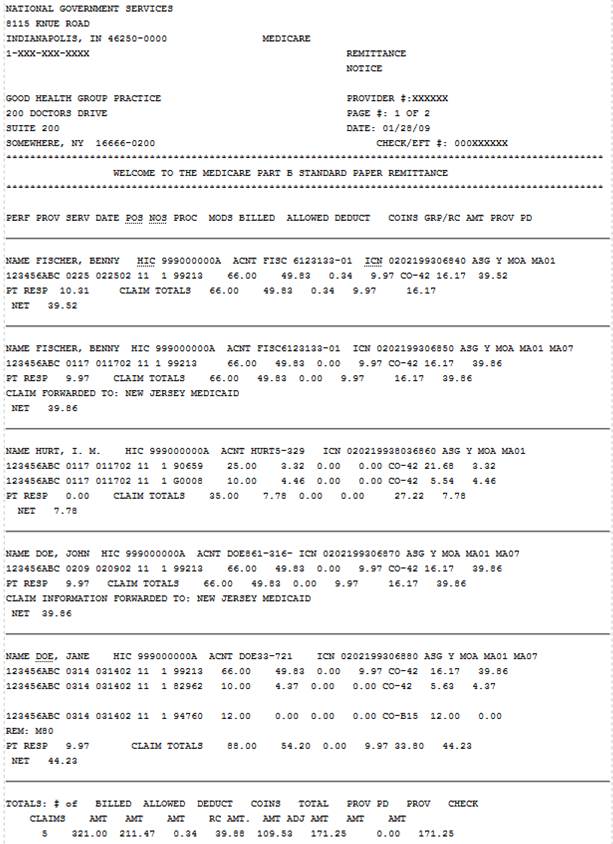

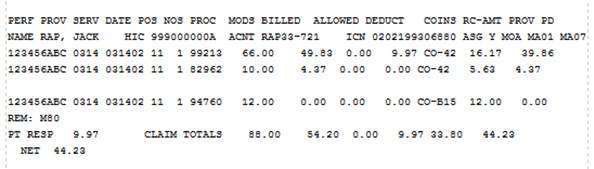

Standard Paper Remittance Example

Section 1

| Field | Description |

|---|---|

| NAME/ADDRESS | Payee name and address. |

| PROVIDER # | Provider Identification Number (PIN). |

| PAGE # | Number of pages of the remittance. |

| DATE | Date the remittance is printed. |

| CHECK/EFT # | Check number or Electronic Funds Transfer number. |

| BULLETIN BOARD | Provider bulletin board. This contains important information on new regulations or reminders of existing regulations. |

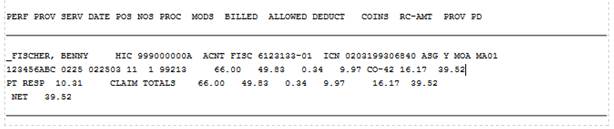

Section 2: Assigned Claims

In the assigned claim section, one claim is displayed in each item of the remittance and each claim is separated by lines. The claims are organized in alphabetic order by last name. The lines within each claim are in descending order by the service date.

| Field | Description |

|---|---|

| NAME | Beneficiary last name, first name and middle initial. |

| HIC # | Beneficiary Medicare Health Insurance Claim Number. |

| ACCT.# | Patient Account Number - A maximum of 20 characters is allowed. |

| ICN # | Internal Control Number assigned by National Government Services. |

| ICN | Internal Control Number = 0203199306840 |

| First two digits | In what method did the claim come into Medicare 01, 03, 04, 06, 07, 08 = paper 02, 09, 10 = electronically |

| Third and fourth digits | what year it came into Medicare |

| Fifth through seventh digits | Julian date (days 1-365) on what calendar date the claim came into Medicare Example: 199 (July 18 ) 2003 |

| ASG | Assignment (Y) |

| MOA | Medicare Outpatient Adjudication Remark Code. MOA Codes are Medicare MIA/MOA remarks and are not service-specific. They are used to convey appeal information and other claim-specific information that does not involve a financial adjustment. MOA codes are explained in a key at the end of the remittance. |

| Field | Description |

|---|---|

| PERF PROV | Performing Provider Identification Number (PIN) |

| SERV DATE | Date(s) of service |

| POS | Two-digit place of service code |

| NOS | Number of services |

| PROC | CPT or HCPCS procedure code |

| MODS | Modifier(s) |

| BILLED | Billed amount for the service |

| ALLOWED | Allowed amount for service prior to deductions or offset |

| DEDUCT | Deductible amount for the service |

| COINS | Coinsurance amount for the service |

| GRP/RC-AMT | ANSI reason codes and dollar amount. If there is more than one, additional adjustment codes and amounts will appear on the next line. The reason codes are explained in a key at the end of the remittance. |

| PROV PD | Amount paid to provider for service |

| REM | ANSI Remark Code. These are referred to as Medicare REF remark codes and are used to signify the presence of service-specific Medicare remarks information messages that cannot be expressed with a reason code. Remark codes are explained in a key at the end of the remittance. |

| PT RESP | Patient responsibility is the unpaid amount for which the patient is liable and includes the patient responsibility for all of the details. |

| CLAIM TOTALS: BILLED AMT |

The total billed amount. |

| ALLOWED AMT | The total allowed amount. |

| DEDUCTIBLE | The total amount applied to deductible. |

| COINSURANCE | The total amount of coinsurance. |

| GRP/RC AMT | The GRP/RC amount is the difference between the billed amount and the allowed amount. |

| PROV PD | The actual payment amount paid to the provider for the service. |

| Field | Description |

|---|---|

| ADJUSTMENTS (ADJS) | Adjustments are only displayed on assigned claims when one of the following fields contains a value: |

| PREV PD | Amount previously paid for these services. The only time this will contain a value is when it is an adjusted claim. |

| INT | Interest amount. |

| LATE FILING CHARGE | This amount can be either a positive or negative value. |

| NET | This field represents the actual amount being paid to the provider. |

| CLAIM INFORMATION | If the claim is being forwarded to a beneficiary’s supplemental |

| FORWARDED TO | Carrier, that payer’s name is printed in this field. |

Note: This field currently shows automatic crossovers only.

Note: To help those providers who balance their billed amounts against the Medicare payments and adjustments, paid and adjusted amounts will be totaled at the end of the assigned claims listing.

| Field | Description |

|---|---|

| TOTALS | Total Claims, Total Billed, Total Allowed, Total Deductible, Total Coinsurance, Total Provider Paid. |

| OFFSET DETAILS | Offsets to payments, perhaps for a prior Medicare overpayment, will be shown as an adjustment from your payment at the summary level, rather than as an adjustment against an individual claim on the remittance notice, since individual claims listed on the remittance notice would not have contributed toward the overpayment being collected. ANSI advised, and CMS concurs, that such withholding should be shown at the provider summary level. |

| PROVIDER LEVEL ADJUSTMENT SECTION: PLB REASON CODE |

This field contains a reason code which indicates what type of provider offset is being applied. A list of offset reason codes is below: |

| Field | Description |

|---|---|

| FB | Forwarding Balance: This can represent an amount under $1 which will be paid in the future, (account payables). This value will be a positive amount. For full claim adjustments which are overpayments, this amount represents an amount which was overpaid on a previous claim. The adjustment detail amount will be a negative amount, and the FCN will contain the original ICN and the HIC for the overpayment. |

| AP | Acceleration of Benefits: Advance payment, used with PO (payout) and AV (advanced payment) financial transactions |

| SL | Student loan |

| WO | Withholding: Result of a previous payment (A/R) |

| LE | Levy |

| IR | IRS |

| L6 | CPT interest offset |

| CS | Adjustment |

| B2 | Rebate |

| 50 | Late filing offset |

| J1 | Nonreimbursable: Used to zero balance provider payment for Centers of Excellence and Medicare Choices Remittances |

| Field | Description |

|---|---|

| FCN | Financial Control Number—assigned by National Government Services |

| HIC | Health Insurance Claim number of overpaid claim |

| AMOUNT | Offset amount |

Section 3: Standard Paper Remittance—Unassigned Claim Information

Information on any unassigned claims will be listed separately, after the assigned claims, to avoid any inadvertent use of unassigned claims information for which Medicare payment is not issued to the provider.

The summary of unassigned claims section contains the same information as the assigned claims section, with the exception of the following:

- The ASG (Assignment) field will contain an N.

- The ADJS (Adjustments) line will display for all unassigned claims since there will be an amount in the PD TO BENE field.

- Paid and adjusted amounts will not be totaled at the end of the unassigned claims listing.

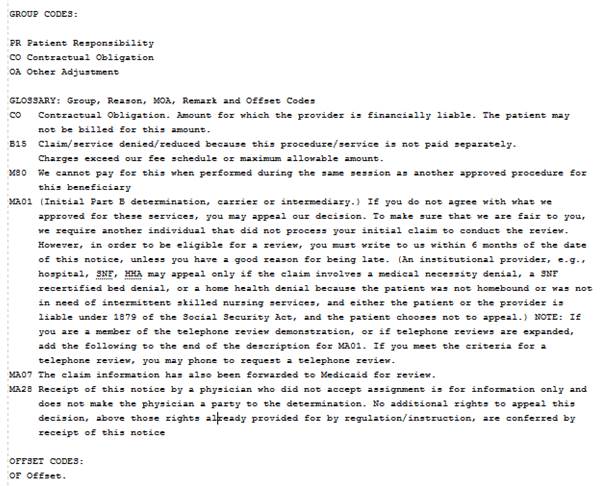

Section 4: Code Descriptions

Group Codes

| Code | Definition |

|---|---|

| PR | Patient responsibility |

| CO | Contractual obligation |

| OA | Other adjustment |

MOA Codes

| Code | Definition |

|---|---|

| MA01 | If you do not agree with what we approved for these services, you may appeal our decision. To make sure that we are fair to you, we require another individual that did not process your initial claim to conduct the review. However, in order to be eligible for a review, you must write to us within 6 months of the date of this notice, unless you have a good reason for being late. |

| MA02 | If you do not agree with this determination, you have the right to appeal. You must file a written request for an appeal within 180 days of the date you receive this notice. Decisions made by a Quality Improvement Organization (QIO) must be appealed to that QIO within 60 days. |

| MA18 | The claim information is also being forwarded to the patient’s supplemental insurer. Send any questions regarding supplemental benefits to them. |

| MA28 | Receipt of this notice by a physician who did not accept assignment is for information only and does not make the physician a party to the determination. No additional rights to appeal this decision, above those rights already provided for by regulation/instruction, are conferred by receipt of this notice. |

| MA130 | Your claim contains incomplete and/or invalid information, and no appeal rights are afforded because the claim is unprocessable. Please submit the correct information to the appropriate fiscal intermediary or carrier. |

Offset Codes

| Code | Definition |

|---|---|

| OF | Offset |

The group, reason, remark, MOA and offset codes used in the assigned and unassigned claims listing will be defined at the end of every remittance.

ANSI X12.835 group codes are used to identify the general category of payment adjustment and will always be shown with a reason code to indicate when you may, or may not, bill a beneficiary for the nonpaid balance of the services or equipment you furnished. This corresponds to payment information already being sent to beneficiaries in their MSN.

Reason codes, and the text messages that define those codes, are used to explain why a claim may have been paid in full. For instance, there are reason codes to indicate that a particular service is never covered by Medicare, that a benefit maximum has been reached, and to identify nonpayable charges which exceed the fee schedule, or a psychiatric reduction. Under the standard format, only reason codes approved by the ANSI X12.835 Insurance Subcommittee, and Medicare-specific supplemental messages approved by CMS, may be used.

ANSI is a nongovernmental private association that sets national standards for not only health care transactions but also for banking, transportation, electrical appliances, and a very wide range of items and services that affect all Americans. The ANSI X12.835 reason code messages are expected to become the standard for use by all health payers in the United States.

The ANSI X12.835 reason codes were designed to replace the large number of different coding systems used by health payers in this country, and to relieve the burden on medical providers to interpret each of the different coding systems. The ANSI X12.835 messages have already been implemented for Medicare electronic remittance advice transactions and are now being extended to our paper notices for both Medicare Part A and Part B claims.

Since the standard ANSI X12.835 reason messages were developed as generic messages to be used by all natio/nal health payers, few are specific to Medicare. With the concurrence of ANSI X12.835, CMS has supplemented the generic reason codes and messages with appeals and developmental codes and messages specific to Medicare. Although reason codes and CMS message codes will appear in the body of the remittance notice, the text of each code that is used will be printed at the end of the notice to facilitate interpretation.

The provider and health payer representatives who participate in the development of these codes, or subsequently reviewed these codes and messages for ANSI X12.835, determined that they are equivalent to previous codes and messages and are adequate for the business needs of the providers.

These messages should be self-explanatory. However, due to differences in terminology among provider types, and in the pursuit of simplification, ANSI X12.835 issued two provisions to keep in mind when you interpret their messages:

- Any references to procedures or services in the reason codes apply equally to products, drugs or equipment.

- References to prescriptions also include certificates of medical necessity.

Standard codes and messages are not customized to report the identity of any third party payer or alternate carrier to whom your claims may have been transferred for processing. You may see one of the following messages in this situation:

"The claim has been transferred to the proper payer/processor for processing. Claim/service not covered by this payer/processor."

"The claim information is also being forwarded to the patient’s supplemental insurer. Send any questions regarding supplemental benefits to them."

However, in some instances, Medicare will also identify the other payer, carrier, or railroad office to whom the data was sent.

Reviewed 8/28/2024