- COVID-19

- CMS Waivers and Services Impacted by End of the Public Health Emergency

- Claim Billing Guidance

- COVID-19 Part A Frequently Asked Questions

- COVID-19 Vaccine and Monoclonal Antibody

- Medicare Coverage of Over-the-Counter COVID-19 Tests

- Medicare Part A and B Billing for the COVID-19 Vaccine and Monoclonal Antibody

- OIG Guidance for COVID-19 Vaccination

COVID-19 Part A Frequently Asked Questions

Table of Contents

- COVID-19 Part A Frequently Asked Questions

- Section B. Diagnostic Laboratory Services

- Section LL. Hospital Billing for Remote Services

- Section MM. Outpatient Therapy Services

COVID-19 Part A Frequently Asked Questions

All providers should note that CMS periodically updates the COVID-19 Frequently Asked Questions (FAQs) on Medicare Fee-for-Service (FFS) Billing document that is available on the CMS website.

National Government Services has identified several of these FAQs* that continue to be received and have included them below for your reference:

*Please note that the section and question numbers correspond to the FAQs in the CMS document.

Section B. Diagnostic Laboratory Services:

- Question: If a COVID-19 diagnostic laboratory test is performed prior to a procedure in an HOPD, ASC or office, is it included as part of the procedure?

Answer: Currently, under the hospital OPPS all available COVID-19 clinical diagnostic laboratory tests are paid separately, thus, if a COVID-19 clinical diagnostic laboratory test is performed prior to a procedure and billed separately, it is not bundled into the payment for the procedure. Specifically with regard to the hospital setting, if the hospital is billing for specimen collection for the COVID-19 clinical diagnostic laboratory test along with another hospital service, the payment for the specimen collection would be packaged into that of the procedure. If the ASC or physician office has obtained a CLIA certificate, the ASC (enrolled as a laboratory) or physician/non physician-practitioner office can bill for tests under the CLFS that the certificate permits them to perform, separate from billing for the procedure that is being furnished. Practitioners, ASCs, and labs should check with their local Medicare Administrative Contractor regarding specific questions of coverage. New 6/19/2020

Section LL. Hospital Billing for Remote Services

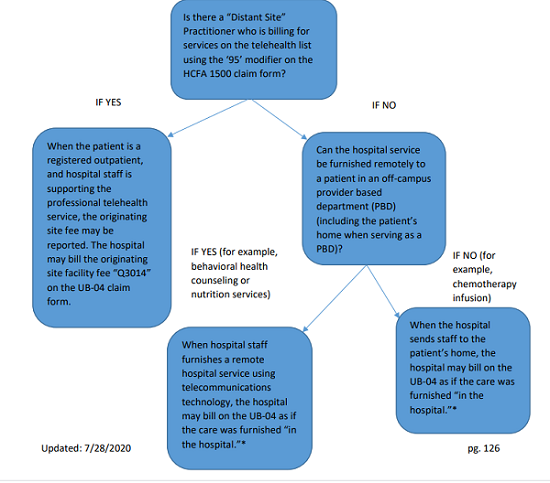

- Question: Is there a tool that can help hospitals better understand flexibilities during the COVID-19 PHE when the beneficiary’s home is serving as a provider-based department of the hospital (that is, where the hospital ensures the location meets all of the conditions of participation, to the extent not waived, and registers the beneficiary as a hospital outpatient)?

Answer: The following graphic shows flexibilities during the COVID-19 PHE and can help inform appropriate hospital billing in such situations. Note that a telehealth service would need to be furnished by a physician or other practitioner located at a distant site in order for a hospital to bill for the originating site facility fee. Please see separate graphic and FAQs in this document on billing for therapy via telehealth.

*The hospital should follow billing instructions for using the PO/PN modifiers as applicable.

*For hospital outpatient department services that do not involve a distant site provider, but are furnished in an off-campus PBD, hospitals should bill for furnished services on the UB-04 as though the care was furnished in the hospital (whether the service is furnished in the patient’s home or via real-time audio-visual communications). We expect hospitals to properly identify services that can be furnished with telecommunications technology. New: 7/28/2020

- Question: Can hospitals and other institutional providers bill for telehealth services that are furnished by certain practitioners?

Answer: In general, no. While a hospital may bill for certain “remote services” furnished in a provider based department (which may include the patient’s home during the COVID-19 PHE), hospitals and other institutional providers are not generally permitted to bill for telehealth services. Telehealth services are professional (that is, physician or practitioner) services furnished using interactive audio and video technology (with certain exceptions in the context of the COVID-19 PHE). The individual physician or practitioner is located at a distant site when furnishing the telehealth service to a beneficiary who is in a different location, the “telehealth originating site.” A hospital may serve as the originating site, and can bill for an originating site facility fee for a registered hospital outpatient who is receiving a telehealth service. Billing for telehealth services is distinct from billing for hospital services and other institutional services, and in most circumstances occurs using professional claims, not institutional claims that would be submitted by the hospital or other institutional provider. We note that prior to the COVID-19 PHE, CAHs that elect CAH Method II billing for professional services bill using the institutional claim format (UB-04). Under the COVID-19 PHE, Method II CAHs, can similarly bill using the institutional claim format for telehealth services furnished by practitioners that can furnish telehealth services as they can outside of the PHE. New: 7/28/2020

- Question: For services furnished to patients in a provider-based department of the hospital (which may include the patient’s home during the COVID-19 PHE), when can a hospital bill for the clinic visit code (G0463, “Hospital outpatient clinic visit”) and when can a hospital bill for the originating site facility fee (Q3014)?

Answer: We remind readers that the provider should bill using the HCPCS code that describes the service(s) that were furnished. The following information may help hospitals determine appropriate billing.

- If a distant site practitioner furnishes a telehealth service to a registered hospital outpatient, and hospital staff provide administrative and clinical support, the hospital may bill for the originating site facility fee (Q3014). It would not be appropriate for the hospital to bill HCPCS code G0463 in this situation.

- HCPCS code G0463 describes a clinic visit furnished in the hospital outpatient setting when the practitioner and the patient are both located within the hospital. Typically, the hospital would bill G0463 when a professional is located in the hospital and furnishes an evaluation and management outpatient service to a hospital outpatient who is also in the hospital. If a physician is practicing from a hospital that has registered the patient as a hospital outpatient in the patient’s home, which is serving as a provider-based department of the hospital, we consider the physician and patient to be “in the hospital” and usual hospital outpatient billing rules would apply in terms of billing for the service(s) furnished. In this situation, there is no distant site practitioner and no telehealth service being furnished. New: 7/28/2020

- Question: When a physician is employed by a hospital and typically furnishes services in the hospital, but furnishes services to a registered hospital outpatient from the physician’s home during the COVID-19 public health emergency, can the hospital bill G0463 as they usually would for a clinic visit furnished in the hospital outpatient setting?

Answer: No, as indicated in FAQ #3 above, the hospital would only bill the originating site facility fee (Q3014) when the visit is furnished via telehealth.

- Question: When there is no Medicare-enrolled professional billing for a telehealth service, can the hospital furnish services remotely?

Answer: Yes, as explained in the interim final rule published in the Federal Register on 5/8/2020, so long as the hospital conditions of participation are met (to the extent not waived during the COVID-19 PHE), the hospital may register the beneficiary in his/her home so long as the patient’s home is serving as a provider-based department of the hospital for the provision of hospital outpatient services. Some services can be furnished remotely using telecommunications technology, such as behavioral health counseling and nutrition counseling. Hospitals should bill for these services on the UB-04 as if the services were furnished in the hospital. Other services, such as a chemotherapy infusion, require hospital staff to physically be in the patient’s home. We expect hospitals to properly identify services that can be furnished with telecommunications technology.

An example list of outpatient therapy, counseling, and educational services that hospital clinical staff can furnish incident to a physician’s or qualified NPP’s service during the COVID-19 PHE to a beneficiary in their home or other temporary expansion location that functions as a PBD of the hospital when the beneficiary is registered as an outpatient of the hospital is posted on the CMS website. New: 7/28/2020

Section MM. Outpatient Therapy Services:

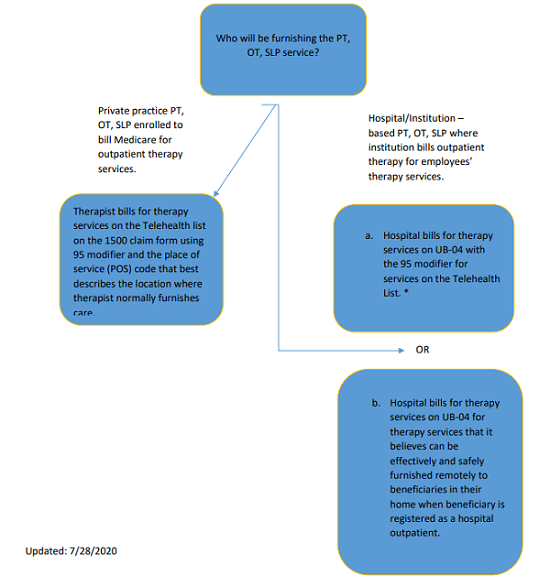

- Question: Is there a graphic that can show me how to bill for outpatient therapy services furnished via telehealth during the COVID-19 Public Health Emergency?

Answer: The below graphic demonstrates the options available to therapists who furnish PT, OT, and SLP services via telehealth or under Hospital Without Walls flexibilities.

*The hospital cannot also bill for the originating site facility fee. New: 7/28/2020.

- Question: How do hospitals bill for outpatient therapy services furnished by employed or contracted therapists using telecommunications technology on the UB-04 claim form during the COVID-19 PHE?

Answer: There are two options available to hospitals and their therapists.

- A hospital could choose to bill for services furnished by employed/contracted PT, OT, or SLP through telehealth, meaning that they would identify furnished services on the telehealth list, they would bill these services on a UB-04 with a “-95” modifier on each line for which the service was delivered via telehealth. No POS code is required (and there is no location for it on the UB-04).

- A hospital could, instead, use the flexibilities available under the Hospital Without Walls initiative. The hospital would register the patient as a hospital outpatient, where the patient’s home acts as a provider-based department of the hospital. The hospital’s employed/contracted PT, OT, SLP would furnish the therapy care that the hospital believed could be furnished safely and effectively through telecommunications technology. The hospital is not limited to services included on the telehealth list (since these would not be considered telehealth services), but must ensure the care can be fully furnished remotely using telecommunications technology. The hospital would bill as if the therapy had been furnished in the hospital and the applicable PO/PN modifier would apply for the patient’s home since it would be serving as an off-campus department of the hospital. The option to bill for telehealth services, along with the -95 modifier, furnished by employed/contracted PTs, OTs and SLPs using applicable audio-visual telecommunications technology applies to the following types of hospitals and institutions:

- Hospital – 12X or 13X (for hospital outpatient therapy services);

- SNF – 22X or 23X (SNFs may, in some circumstances, furnish Part B PT OT SLP services to their own long-term residents);

- CAH – 85X (CAHs may separately provide and bill for PT, OT, and SLP services on 85X bill type);

- Comprehensive Outpatient Rehabilitation Facility (CORF) – 75X (CORFs provide ambulatory outpatient PT, OT, SLP services);

- Outpatient Rehabilitation Facility (ORF) – 74X (ORFs, also known as rehabilitation agencies, provide ambulatory outpatient PT and SLP, as well as OT services); and

- HHA – 34X (agencies may separately provide and bill for outpatient PT/OT/SLP services to persons in their homes only if such patients are not under a home health plan of care). New: 7/28/2020

- Question: In the scenario in which the hospital chooses to bill for telehealth services of an employed/contracted PT, OT, or SLP using a 95 modifier on each applicable service line on a UB-04 for a registered outpatient, can the hospital also bill for the originating site facility fee (Q3104)?

Answer: No. In this scenario, the hospital must bill on a UB-04 for all PT, OT, and SLP services provided to their outpatients, even when those services are furnished by private practice therapists under arrangement with the hospital, due to provider billing rules and restrictions on where private practice therapists are paid—their offices and patient’s homes. In these cases, the hospital cannot bill for the originating site facility fee in addition to the service(s) furnished via telehealth.

Posted 7/28/2020