- Avoiding Reason Code 38200

- Correcting Reason Code 37253

- Incarcerated or Unlawfully Present in the U.S. Claim Rejections (U538H, U538Q)

- Expanded Home Health Value-Based Purchasing Model

- Billing the Home Health Period of Care Claim - PDGM

- Disposable Negative Pressure Wound Therapy Services Under Home Health

- Home Health Prospective Payment System Booklet

- Home Health Third Party Liability Demand Billing

- Home Health Demand Billing

- Notice of Admission Questions and Answers

- Billing the Home Health Notice of Admission Electronically

- Billing the Home Health Notice of Admission via DDE

- Home Health Transfers

- Home Health Agency Transfer and Dispute Protocol

- Late Notice of Admission - The Exception Process

- Reporting Home Health Periods with No Skilled Visits

- Telehealth Home Health Services

- Reporting Site of Service Codes for Home Health Care

- PDGM Resources

- Billing G-Codes for Therapy and Skilled Nursing Services

- Correcting and Avoiding Reason Code 38157: Duplicate Request for Anticipated Payment

- Correcting and Avoiding Reason Code C7080: Inpatient Overlap

- Completing the Advance Beneficiary Notice for Home Health Agency Demand Claims

- The Medicare Home Infusion Therapy Benefit and Home Health Agencies

- Home Health Therapy Billing

- Home Health Billing When a New MBI is Assigned

- 30-Day Home Health Therapy Reassessment Schedule

Home Health Third Party Liability Demand Billing

Table of Contents

- Background

- What is a Demand Bill?

- Requirements for Submission

- How to Submit a TPL Demand Bill

- Related Content

Background

Both Medicare beneficiaries and providers have certain rights and protections related to financial liability under the FFS Medicare Programs. These financial liability and appeal rights and protections are communicated to beneficiaries through notices given by providers.

There are times when a beneficiary may be eligible for traditional Medicare and Medicaid (dually-eligible). When a HHA feels that Medicare will not cover a service for a specific beneficiary, the provider issues an ABN Form (CMS-R-131). The ABN provides the beneficiary with the option to have a demand claim submitted to Medicare for review of the coverage determination.

What is a Demand Bill?

CMS defines a demand bill as a request by a beneficiary or his/her representative that a claim be submitted to Medicare in order to obtain a determination for services which the provider believes are noncovered by Medicare. The beneficiary agrees to be fully and personally responsible for payment in the event that Medicare does not pay.

A TPL demand bill is submitted by the provider when a state agency requests Medicare review services the HHA deems not to be medically reasonable and necessary, or when the HHA determines the beneficiary failed to meet the homebound, intermittent or non-custodial care requirements, and therefore would not be reimbursed if billed.

For dually-eligible patients, third party payers may cover the services in question, but HHAs are required to first bill Medicare for the disputed services.

If, after its review, Medicare decides some or all of the disputed services received on the demand bill are covered and pays for them, the HHA may bill the state agency only for the services Medicare denied coverage due to not meeting Medicare coverage guidelines. If the Medicare determination upholds the HHA’s judgment that the services were not medically reasonable and necessary, or that the beneficiary failed to meet the homebound or intermittent care requirements, the HHA can bill the state agency/Medicaid, unless the MAC determines the ABN notification was not properly executed, or some other factor changed liability for payment of the disputed services back to the HHA.

Requirements for Submission

Prior to submitting the TPL demand bill, the HHA must first submit an NOA. The HHA submits the NOA when the HHA has obtained a verbal or written order from the physician that contains the services required for the initial visit, and the HHA has conducted an initial visit at the start of care. The NOA must be submitted and accepted by the MAC within five calendar days after the admission date. The NOA establishes an admission period in the Medicare system in order to show the beneficiary is under home health care.

In order to submit a demand bill, the HHA must meet all of the following criteria:

- The HHA must have determined that the services under the plan of care for which the demand bill is being requested (i.e., services in dispute) do not meet Medicare’s coverage criteria;

- An NOA must be sent on a 32A type of bill to establish a home health admission period, and the final claim for the period must be sent on a 32X type of bill (i.e., 329, or 327 if an adjustment bill); and

- There must have been at least one service provided to the patient for the established period.

If there are successive periods of care in dispute, a period of care claim must be billed for each 30-day period. The claim for the period should be submitted either after discharge or at the end of the 30-day period. It’s possible that the claim may not cover a full 30-day period if the patient was discharged prior to the end of the 30-day period.

How to Submit a TPL Demand Bill

First, an NOA must be submitted to establish the home health admission. The NOA is a requirement for home health billing and must be in the system before any claims can be processed. The NOA is formatted the same as any other NOA for home health patients, i.e., all billing requirements are still in place. There are no special billing requirements for NOAs when billing in a demand situation. Once the NOA has processed, the HHA can submit the period of care claim(s). A claim is submitted for every 30 days of home health services. This does not change in demand bill situations. Keep the following points in mind when submitting the home health TPL demand bill:

- A signed ABN* must be on file to submit a demand claim.

- Claims are for 30-day periods (if a full period of care) or admit to discharge.

- Reflect covered charges for services that meet Medicare coverage criteria and non-covered charges for services in dispute (it’s possible that the demand claim may contain all non-covered charges).

- If billing with covered and noncovered charges, any noncovered lines should be billed with modifier ‘GA’

- Condition Code 20 must be on the claim to indicate there are services for which the state agency/Medicaid is requesting billing. The presence of condition code 20 assures medical review of the demand bill.

- All other billing requirements apply to TPL demand claims as to any other period of care claim (see Billing the Home Health Period of Care Claim – PDGM job aid)

* There must be an appropriate reason for the lack of a signature recorded on the ABN (such as a properly annotated signature refusal) if it is not signed by the beneficiary.

The following screen shots serve as an example of how to submit a home health TPL demand claim.

The required fields are bolded with field descriptions and associated valid values in the tables below.

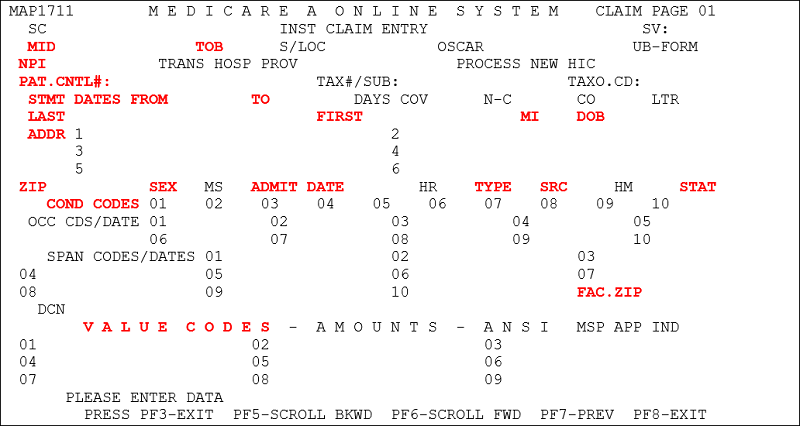

Claim Page 1:

| Field | Description/Notes |

|---|---|

| MID | Medicare Identification (Beneficiary’s Medicare Number) |

| TOB | Type of Bill – 329 (original claim submission) Type of Bill – 327 (when appropriate - correction to a previously submitted bill) |

| NPI | National Provider Identifier Number |

| PAT. CNTL# | Patient Control Number – enter the number assigned to the patient’s medical/health record. |

| STMT DATES FROM and TO (Statement Covers Period "From and "Through") | Enter the beginning and ending date of the period covered by the claim. The “From” date on an initial period must match the NOA date. (MM/DD/YY) The “To” date is either the date of discharge, transfer, or (for continuous care periods) 29 days after the “From” date. (MMDDYY) |

| LAST, FIRST, MI, ADDR, DOB, SEX | Patient’s last name, first name, and middle initial (if applicable), full address, date of birth (MMDDYYYY) and sex code (M/F) |

| ADMIT DATE | The HHA enters the same date of admission that was submitted on the NOA for all periods until the patient is discharged. (MMDDYY) |

| TYPE | Enter the appropriate NUBC code for the admission type. |

| SRC (Source of Admission) | Enter the appropriate NUBC code for the source of admission. |

| STAT | Patient Status – Enter the code that most accurately describes the patient’s status as of the “To” date of the billing period. Any applicable NUBC approved code may be used. |

| FAC. ZIP | Facility Zip Code of the provider or subpart (9 digit code). |

| COND CODES | Condition Code 20 must be present on the claim requesting demand billing. Enter any other codes appropriate to describe conditions that apply to the billing period. |

| VALUE CODES | Enter Value Code 61 with the appropriate CBSA Code. The five-digit CBSA code must be entered with two trailing zeroes. Enter Value Code 85 with the appropriate FIPS code. The five-digit FIPS code must also be entered with two trailing zeroes. |

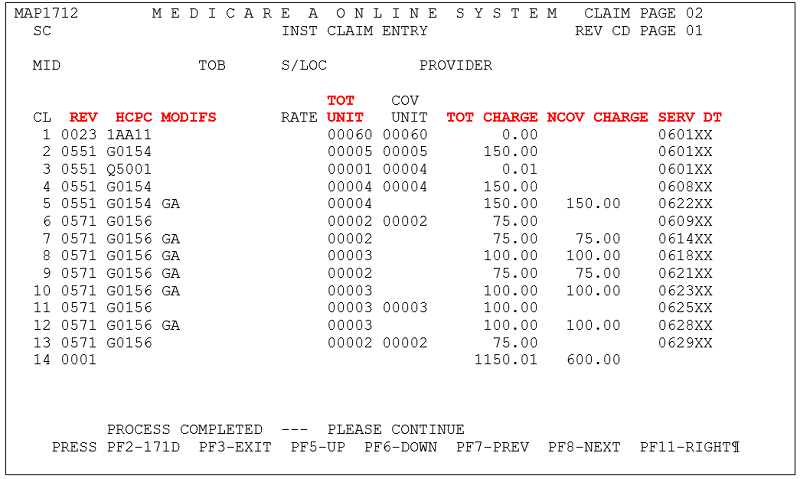

Claim Page 2 – Covered and Noncovered Charges

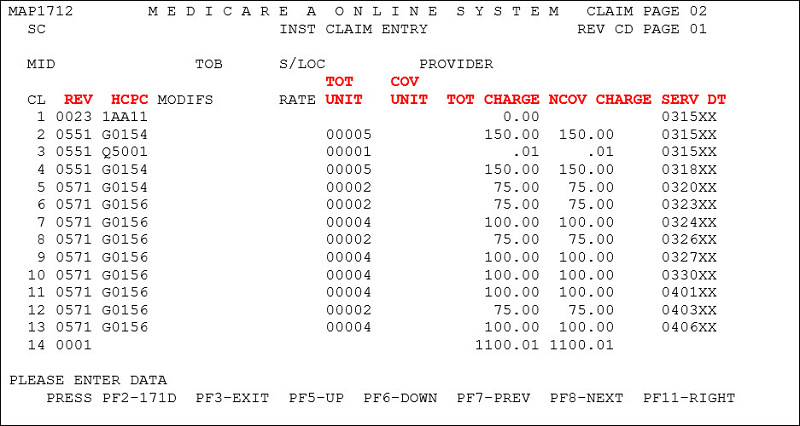

Claim Page 2 – All Noncovered Charges

| Field | Description/Notes |

|---|---|

| REV | Revenue Codes – Claims must report a Revenue Code line 0023 matching the one submitted on the RAP for the period. Claims must also report all services provided to the patient within the period. |

| HCPC | Enter the HIPPS code for the 0023 revenue line. For all other revenue lines, report HCPCS codes as appropriate for each revenue code. |

| MODIFS | Modifiers – report appropriate modifiers for the HCPCS code. Append the GA modifier to noncovered lines when billing covered and noncovered services on the same claim. |

| TOT UNITS | Total service units – No units of service are required on the 0023 revenue line. Units of service for other Revenue Codes are reported as appropriate. |

| TOT CHARGE | Total Charges – The total charge for the 0023 revenue line must be zero. Total charges for other Revenue Codes are reported as appropriate. |

| NCOV CHARGE | The total noncovered charges for services in dispute are entered in this field. |

| SERV DT | Service Date – Report the date of the first service provided under the HIPPS code reported on the 0023 revenue line. Report all other service dates for additional revenue codes as appropriate. (MMDDYY) |

There are no special instructions for claim pages 3 and 5 – the information entered on these pages should match the RAP for the same period and follow the same billing requirements for any other home health period of care claim. You may enter Remarks on claim page 4 to explain the reason for demand billing, though it is not required.

Related Content

- A copy of the ABN and instructions on its use can be found on CMS’ website

- CMS IOM Publication 100-04, Medicare Claims Processing Manual

- Chapter 1, Section 70 (Timely filing)

- Chapter 10, Section 40 (General HHA billing on the UB-04)

- Chapter 10, Section 50 (Demand billing)

- Chapter 30, Sections 40-50 (Scope and description of ABN)

- CR 12242: Section 50 in Chapter 30 of Publication (Pub.) 100-04 Manual Update

- There is a separate job aid on regular demand billing as well as job aids on billing the home health NOA and billing the home health claim. These are located with all other home health billing job aids on the NGS website.

Reviewed 6/23/2025