PC-ACE Quick Reference Guide: Medicare Secondary Payer

The following are Medicare A (Institutional) instructions for entering line item and claim information into PC-ACE when Medicare is the secondary payer.

Situations where Medicare is the secondary payer must be submitted electronically in the following manner:

- Bill the primary insurance and receive an explanation of benefits before you can electronically bill Medicare as the secondary payer.

- The primary payer must be in PC-ACE in the Payer Information database.

The following patient information is sample data only which is used in the examples below

Sample Data Used

| Field | Example Data |

|---|---|

| Primary Insurance | Health Source (01041) |

| Primary Insurance Address | 1234 No Road Miami, FL 33012 |

| Commercial Insurance, Group Name | Walmart, Group Number - 55555 |

| Relationship | Self (18) |

| Insured ID | 654654654 |

| Patient name | Mary B Jones |

| Patient address | 532 Riverside Ave Floor 5 Jacksonville, FL 32202 |

| Patient account # | MSP Part A |

| Sex | Female |

| Birth Date | 01/01/1935 |

| Employ Status | 9 (Widowed, employment not known, and not a student) |

| Signature is on file | Y |

| Release of information date | 05/05/2001 |

| Secondary Insurance | Medicare FL (09101) |

| Insured ID | MBI |

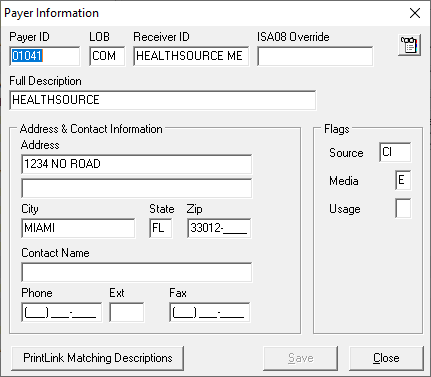

Payer Information Screen

The Payer Information Screen is located under the Reference File Maintenance menu. The Payer Information must be set up before any Patient information is entered.

| Field | Description |

|---|---|

| Payer ID | Payers National Identification number |

| LOB | Line of Business must be COM |

| Receiver ID | Leave blank if not already on file |

| ISA08 Override | Leave blank |

| Full Description | Name of payer |

| Address & Contact Information | All fields are optional |

| Flags: | |

| Source | Payment source code for this payer. Use "CI" (Commercial Insurance) Ensure Primary Payer is on PC-ACE Payer file as a Commercial. |

| Media | Specifies the payer receives claims electronically. Use "E" (Electronic) |

| Usage | Indicates whether the payer record is restricted. Use "U" (Institutional) |

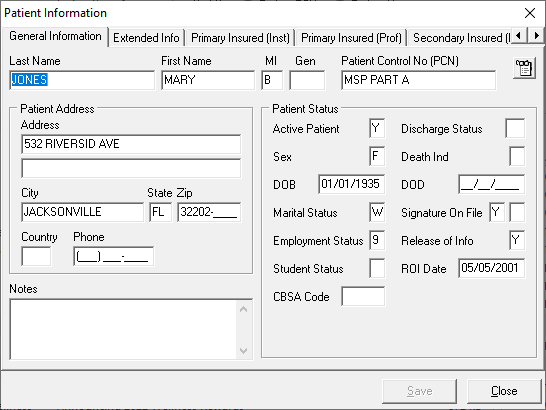

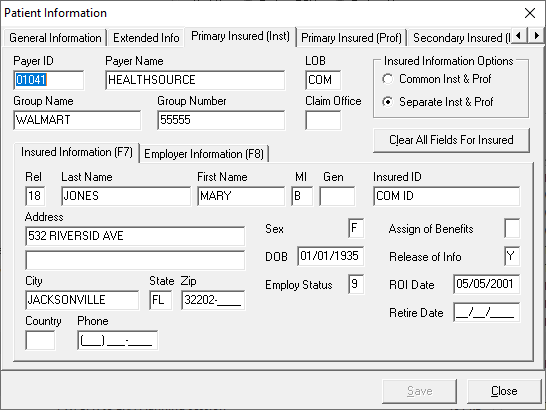

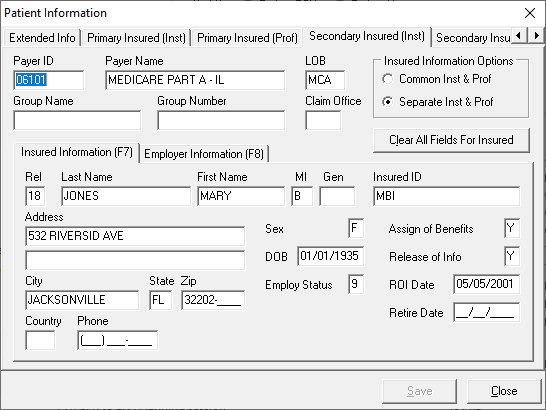

Patient Information Screen

The Patient Information Screen/database is located under the Reference File Maintenance menu and must be set up with the primary payer reflected and Medicare as the secondary insurance payer. Note: Any changes to the patient insurance must be updated, here, in the Patient Information Screen (i.e.: Medicare becomes primary, change in insurance company, etc.).

General Information tab – information such as the patient's name, address, birth date, any various status flags. This example does not contain information on the patient’s legal representative; therefore no information is entered on the Extended Info tab.

Primary Insured (Inst) tab – provides the primary payer ID and name, primary insured and employer information of the primary insured.

Secondary Insured (Inst) tab – provides the secondary payer ID and name, secondary insured and employer information of the secondary insured.

Entering an Institutional Claim

After completing the Payer Information and Patient Information screens, now it’s time to enter the claim information.

Sample Data Used

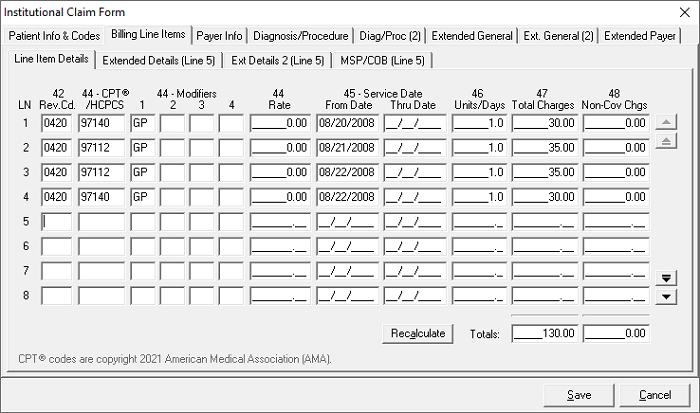

| Line | REV Code | CPT W/Modifier | Date | Billed Amount |

|---|---|---|---|---|

| 1. | 420 | 97140 GP | 8/20/08 | $30.00 |

| 2. | 420 | 97112 GP | 8/20/08 | $35.00 |

| 3. | 420 | 97112 GP | 8/20/08 | $35.00 |

| 4. | 420 | 97140 GP | 8/20/08 | $30.00 |

Sample Data from Primary Payer Payment Information

| Line# | Billed Amount (What You Charged) | Primary Paid Amount (Amount Other Insurance Paid) | Difference Between Billed Amount and Primary Paid amount |

|---|---|---|---|

| 1. | $30.00 | $20.00 | $10.00 |

| 2. | $35.00 | $20.00 | $15.00 |

| 3. | $35.00 | $20.00 | $15.00 |

| 4. | $30.00 | $20.00 | $10.00 |

| Total | $80.00 | ||

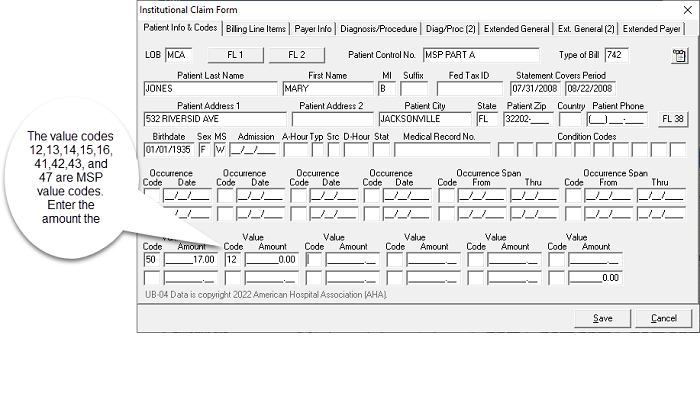

Patient Info and Codes tab - From the “Institutional Claim Form” screen, select the "Patient Info & Codes" tab. Enter the appropriate billing information to include the MSP value code and amount.

Note: The complete listing of value codes are found in the CMS IOM Publication 100-05, Medicare Secondary Payer Manual, Chapter 3

Billing Line Items tab - Enter the required information for line. Then select the “MSP/COB (Line xx)” tab. (Example: If you are on service line 1, it will read MSP/COB [Line 1]. Tab line number will change with each service line you enter.)

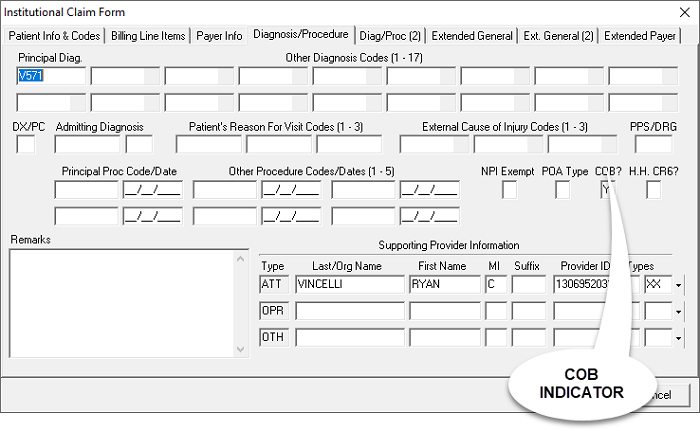

Diagnosis/Procedure tab – Enter a “Y” in the “COB?” field to activate the MSP/COB and COB Info tabs.

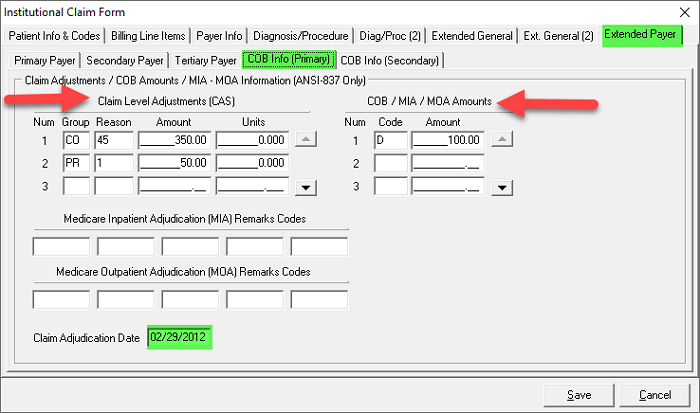

Claim Level MSP Reporting

Note: The other insurance remittance determines if MSP information is reported by the Claim Level or the Line Level.

- When selecting “Y” on the “COB?” field, a new tab will appear under the “Extended Payer” tab. This tab is called “COB Info Primary” and “COB Info Secondary”.

- On this new tab under the “COB/MIA/MOA Amounts” column the provider must list the qualifier “D” and the amount paid by the other payer

- Under the “Claims Level Adjustment (CAS)” column the provider must:

- Account for the difference between the Total Charges (billed amount) on the “Line Items Detail” sub tab of the “Billing Line Items” tab and “D” with the appropriate codes that are provided in your remittance advice from the primary payer.

- The following is an example – Providers must use the information contained in their primary payer remit to determine the codes and amounts in the CAS column.

- This claim example was submitted to Blue Cross. The claim total was $500. Blue Cross paid $100. The patient had a deductible of $50 and $350 was sent back to the provider with as contractual adjustments listed under code CO 45 in the remit.

- Under the “COB/MIA/MOA Amounts” enter a "D" qualifier and an amount of $100 to show what Blue Cross paid the provider for this claim.

- This leaves $400 that the provider must account for under the “CAS” heading. This information must be found on the remittance advice from the other payer.

- In this case the provider lists a contractual obligation with code 45 (CO 45) of $350 and a patient deductible (PR 1) of $50.

- The remittance date must be listed in the bottom left hand corner in the “Claim Adjudication Date” field.

Reviewed 9/23/2024