Chapter IV: Inquiries Submenu (01)

DRG (Pricer/Grouper) (11)

Purpose

This option will be used by the provider to research PPS information as it pertains to an inpatient stay.

To access the DRG (Pricer/Grouper) option from the FISS Online Inquiries submenu, type “11” at the Enter Menu Selection: prompt, then press the <Enter> key.

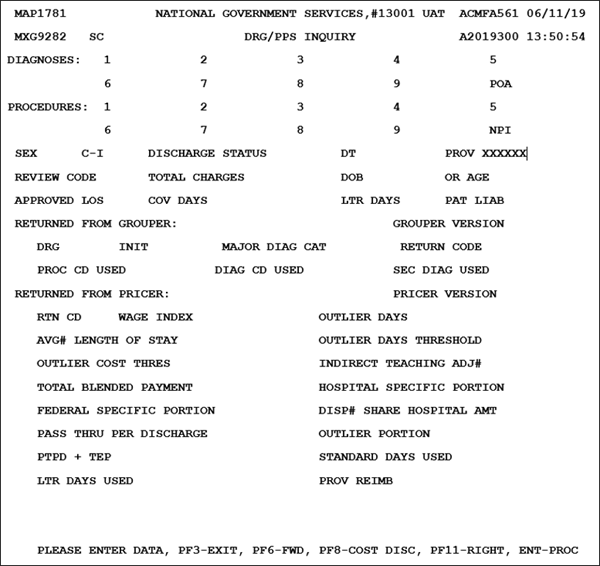

Upon selecting the DRG (PRICER/GROUPER) Option, the Initial DRG PPS INQUIRY Screen is available:

To research PPS information as it relates to an inpatient stay, enter the following in the Initial DRG PPS Inquiry screen (minimum entries noted):

Note: When moving between fields to enter data in the FISS DDE System, providers must use their <Tab> key.

- Enter the diagnosis codes in the DIAGNOSES fields. Enter the primary diagnosis in field 1.

- Up to 25 ICD-10 diagnosis codes for conditions coexisting on a particular claim may be entered. Press <PF6/F6> to enter additional codes.

- Each of the fields accommodates a six-digit alphanumeric code, with two additional positions. The seventh position is blank, and the eighth position is the first character of the first present on admission (POA) indicator (for every principal and secondary diagnosis).

- Valid POA indicators are:

- Y – Yes. Present at the time of inpatient admission

- N – No. Not present at the time of inpatient admission

- U – Unknown. The documentation is insufficient to determine if the condition was present at the time of the inpatient admission

- W – Clinically undetermined. The provider is unable to clinically determine whether the condition was present at the time of the inpatient admission

- Blank – Not acute care; POA indicator does not apply

- Enter the End of POA indicator in the POA field.

- A single-digit POA indicator reported for every diagnosis reported on claim.

- Valid values are:

- Z – Indicates the end of POA indicators for principal and, if applicable, other diagnoses

- X – Indicates the end of POA indicators for principal and, if applicable, other diagnoses in special data processing situations that may be identified by CMS in the future.

- Enter the procedure codes in the PROCEDURES field. Enter the primary procedure code in field 1.

- Up to 25 ICD-10 procedure codes performed during the billing period covered by this claim may be entered. Press <PF6/F6> to enter additional codes.

- Required for inpatient claims.

- No decimals are used when entering these codes.

- Enter the beneficiary sex in the SEX field.

- Valid values are:

- M – male

- F – female

- Enter the century indicator in the C–I field.

- Valid values are:

- 8 = The beneficiary was born in the 1800s

- 9 = The beneficiary was born in the 1900s

- Enter the discharge status code in the Discharge Status field.

- Identifies the status of the patient at the statement through date

- Valid values are:

- 01 = Discharged to home or self-care (routine discharge)

- 02 = Discharged/transferred to another short-term general hospital

- 03 = Discharged/transferred to SNF

- 04 = Discharged/transferred to an ICF

- 05 = Discharged/transferred to a designated cancer center or children’s hospital

- 06 = Discharged/transferred to home under care of organized home health service organization

- 07 = Left against medical advice

- 09 = Admitted as an inpatient to this hospital

- 20 = Expired

- 30 = Still a patient

- 40 = Expired at home (hospice claims only)

- 41 = Expired in a medical facility (hospice claims only)

- 42 = Expired–place unknown (hospice claims only)

- 43 = Discharged/transferred to a federal health care facility

- 50 = Discharged/transferred to hospice–home

- 51 = Discharged/transferred to hospice–medical facility

- 61 = Discharged/transferred within this institution to a hospital-based Medicare-approved swing bed

- 62 = Discharged/transferred to an inpatient rehabilitation facility including distinct part units of a hospital

- 63 = Discharged/transferred to long-term care hospitals

- 64 = Discharged/transferred to a nursing facility certified under Medicaid but not certified under Medicare

- 65 = Discharged/transferred to a psychiatric hospital or psychiatric distinct part unit of a hospital

- 66 = Discharged/transferred to a CAH (effective 1/1/2006)

- 70 = Discharge/transfer to another type of health care institution not defined elsewhere in the code list (effective 4/1/2008)

- Enter the discharge date in the DT field

- MMDDYY format

- Enter total charges (as submitted on claim) in the TOTAL CHARGES field.

- Enter either:

- The beneficiary’s date of birth in MMDDYYYY format in the DOB field, or

- The beneficiary’s age in the OR AGE field

- Enter the number of length of stay days in the APPROVED LOS field

- Enter the total number of covered days in the COV DAYS field

- Press <Enter> key

Upon entering the required claim information, the DRG/PPS Inquiry Screen is updated to include information returned from Grouper and PRICER software:

| Field | Description |

|---|---|

| DIAGNOSES | Diagnosis code(s) (entered by provider) |

| POA | End of POA indicator (entered by provider) |

| PROCEDURES | Procedure code(s) (entered by provider) |

| NPI | National Provider Identifier (NPI) (entered by system) |

| SEX | Beneficiary sex (entered by provider) |

| C-I | Century indicator(entered by provider) |

| DISCHARGE STATUS | Discharge status code (entered by provider) |

| DT | Discharge date – entered by provider |

| PROV | Medicare provider number (entered by system) |

| REVIEW CODE | Indicates the code used in calculating the standard payment. Valid Values 00 = Pay with outlier – Use of this code will calculate the standard payment and will also attempt to pay only cost outliers, day outliers expired 10/1/1997 03 = Pay per diem days – Use of this code will calculate a per diem payment based on the standard payment if the covered days are less than the ALOS for the diagnosis-related group (DRG). If the covered days equal or exceed the ALOS, the standard payment is calculated and will also calculate the cost outlier portion of the payment if the adjusted charges on the bill exceed the cost threshold. 06 = Pay transfer no cost – Use of this code will pay per diem payment based on the standard payment if the covered days are less than the ALOS for the DRG. If covered days equal or exceed the ALOS, the standard payment is calculated and will not calculate any cost outlier portion of the payment 07 = Pay without cost – Use of this code will calculate the standard payment and will also calculate the day outlier portion of the payment if the covered days exceed the outlier cutoff for the DRG 09 = Pay transfer special DRG – Post-acute transfers for DRGs 209, 110, 211, 014, 113, 236, 263, 264, 429, and 483. Post-acute transfers will calculate a per diem payment based on the standard DRG payment if the covered days are less than the ALOS for the DRG. If covered days equal or exceed the ALOS, the standard payment is calculated and will also calculate the cost outlier portion of the payment if the adjusted charges on the bill exceed the cost threshold. |

| TOTAL CHARGES | Total charges (entered by provider) |

| DOB | Beneficiary’s date of birth (entered by provider) |

| OR AGE | Beneficiary’s age (entered by provider) |

| APPROVED LOS | Approved length of stay (entered by provider) |

| COV DAYS | Covered Medicare days (entered by provider) |

| LTRDAYS | Identifies the number of lifetime reserve days used for a particular claim |

| PAT LIAB | Patient liability due– Identifies the dollar amount owed by the beneficiary to cover any coinsurance days or noncovered days or charges |

Returned From Grouper:

| Code | Description |

|---|---|

| GROUPER VERSION | Indicates the program identification number for the Grouper program used |

| D.R.G. | Diagnosis related group – Identifies the code assigned by the CMS Grouper program using specific data from the claim (e.g., length of stay [LOS], covered days, sex, age diagnosis and procedure codes, discharge date, and total charges) |

| INIT | Initial Diagnosis Related Group code assigned by the CMS grouper program using specific data from the claim, such as length of stay, covered days, sex, age, diagnosis and procedure codes, discharge date, and total charges. This additional MS-DRG field will allow the systems to pass on the initial MS-DRG in the event a Hospital Acquired Condition (HAC) impacts the final MS-DRG assignment (four-digit numeric field, led by a zero [0]) |

| MAJOR DIAG CAT | Major diagnostic category – Identifies the category in which the DRG resides Valid Values 01 = Diseases and disorders of the nervous system 02 = Diseases and disorders of the eye 03 = Diseases and disorders of the ear, nose, mouth, and throat 04 = Diseases and disorders of the respiratory system 05 = Diseases and disorders of the circulatory system 06 = Diseases and disorders of the digestive system 07 = Diseases and disorders of the hepatobiliary system and pancreas 08 = Diseases and disorders of the musculoskeletal system and connective tissue 09 = Diseases and disorders of the skin, subcutaneous tissue, and breast 10 = Endocrine, nutritional, and metabolic diseases and disorders 11 = Diseases and disorders of the kidney and urinary tract 12 = Diseases and disorders of the male reproductive system 13 = Diseases and disorders of the female reproductive system 14 = Pregnancy, childbirth, and the puerperium 15 = Newborns and other neonates with conditions originating in the perinatal period 16 = Diseases and disorders of the blood, blood forming organs, and immunological disorders 17 = Myeloproliferative diseases and disorders, and poorly differentiated neoplasms 18 = Infections and parasitic diseases (systemic or unspecified sites) 19 = Mental diseases and disorders 20 = Alcohol/drug use and alcohol/drug induced organic mental disorders 21 = Injuries, poisonings, and toxic effects of drugs 22 = Burns 23 = Factor influencing health status and other contacts with health services 24 = Multiple significant trauma 25 = Human immunodeficiency virus infections |

| RETURN CD: | Return code – Identifies the status of the claim when it has returned from the Grouper program Valid Values Codes 00–49 describe how the bill was priced 00 = Priced standard DRG payment 01 = Paid as day outlier (no longer paid as of 10/1/1997) 02 = Paid as cost outlier 03 = Transfer paid on a per diem basis up to and including the full DRG 05 = Transfer paid on a per diem basis up to and including the full DRG which also qualified for a cost outlier payment 06 = Transfer paid on a per diem basis up to and including the full DRG—provider refused cost outlier 10 = DRG is 209, 210, or 211 and postacute transfer 12 = Post-acute transfer with specific DRGs: 014, 113, 236, 264, 429, 483 14 = Paid normal DRG payment with per diem days = or > GM ALOS 16 = Paid as cost outlier with per diem days = or > GM ALOS Codes 51–98 describe why the bill was not priced 51 = No provider specific information found 52 = Invalid MSA in provider file 53 = Waiver state/not calculated by PPS 54 = DRG not < 001, or > 511, or = 214, or = 215, or = 221, or = 222, or = 438, or = 456, or = 457, or = 458, or = 459, or = 460, or = 469, or = 470, or = 472, or = 474 55 = Discharge date is earlier than provider’s effective start date or discharge date earlier than provider’s MSA effective start date for PPS 56 = Invalid LOS 57 = Review code invalid (not 00, 03, 06, 07, 09) 58 = Total charges not numeric 61 = LTR days not numeric or bill LTR days greater than 60 days 62 = Invalid number of covered days 65 = Pay code not = A,B or C on provider specific file for capital 67 = Cost outlier with LOS greater than covered days 98 = Cannot process bill older than five years |

| PROC CD USED | Identifies the ICD-10 procedure code used by the Grouper program for calculation |

| DIAG CD USED | Identifies the ICD-10 diagnosis code used by the Grouper program for calculation |

| SEC DIAG USED | Identifies the secondary ICD-10 diagnosis code used by the Grouper program for calculation |

Returned From Pricer:

| Code | Description |

|---|---|

| PRICER VERSION | Identifies the program version number for the Pricer program used |

| RTN CD | Return code – Identifies the status of the claim when it has returned from the Pricer program Valid Values Codes 00–16 describe how the bill was priced 00 = Priced standard DRG payment 01 = Paid as day outlier (no longer paid as of 10/1/1997) 02 = Paid as cost outlier 03 = Transfer paid on a per diem basis up to and including the full DRG 05 = Transfer paid on a per diem basis up to and including the full DRG which also qualified for a cost outlier payment 06 = Transfer paid on a per diem basis up to and including the full DRG—provider refused cost outlier 10 = DRG is 209, 210 or 211 and post-acute transfer 12 = Post-acute transfer with specific DRGs: 014, 113, 236, 264, 429, 483 14 = Paid normal DRG payment with per diem days = or > GM ALOS 16 = Paid as cost outlier with per diem days = or > GM ALOS Codes 51–98 describe why the bill was not priced 51 = No provider specific information found 52 = Invalid MSA in provider file 53 = Waiver state/not calculated by PPS 54 = DRG not < 001, or > 511, or = 214, or = 215, or = 221, or = 222, or = 438, or = 456, or = 457, or = 458, or = 459, or = 460, or = 469, or = 470, or = 472, or = 474 55 = Discharge date is earlier than provider’s effective start date or discharge date earlier than provider’s MSA effective start date for PPS 56 = Invalid LOS 57 = Review code invalid (not 00, 03, 06, 07, 09) 58 = Total charges not numeric 61 = LTR not numeric or bill LTR days greater than 60 days 62 = Invalid number of covered days 65 = Pay code not = A, B or C on provider specific file for capital 67 = Cost outlier with LOS greater than covered days 98 = Cannot process bill older than five years |

| WAGE INDEX | Indicates the wage index as supplied by CMS to be used for the state in which the services were provided to determine reimbursement rates for the services rendered |

| OUTLIER DAYS | Identifies the number of days beyond the cutoff point for the applicable DRG |

| AVE# LENGTH OF STAY | Identifies the CMS predetermined LOS based on certain claim data |

| OUTLIER DAYS THRESHOLD | Identifies the number of days of utilization permissible for the DRG code in this claim. Day outlier payment is made when the length of stay (including days for a beneficiary awaiting SNF placement) exceeds the length of stay for a specific DRG plus the CMS mandated adjustment calculation |

| OUTLIER COST THRES | If the claim has extraordinarily high charges, and does not qualify as a day outlier, then the claim may qualify as a cost outlier. The additional payment amount is the applicable Federal rate percentage times 75 percent of the difference between the hospital’s cost for the discharge and the threshold criteria established for the applicable DRG |

| INDIRECT TEACHING ADJ# | Indirect teaching adjustment – Identifies the amount of the adjustment calculated by the Pricer program for teaching hospitals |

| TOTAL BLENDED PAYMENT | Identifies the total PPS payment |

| HOSPITAL SPECIFIC PORTION | Identifies the hospital portion of the total blended payment used in reimbursing this PPS claim |

| FEDERAL SPECIFIC PORTION | Identifies the federal portion of the total blended payment used in reimbursing this PPS claim |

| DISP# SHARE HOSPITAL AMT | Disproportionate share hospital amount – Defined as the percentage of a hospital total Medicare Part A patient days attributable to Medicare patients who are also SSI (this percentage will be supplied by CMS) |

| style="vertical-align: top"PASS THRU PER DISCHARGE | Identifies the pass through per discharge |

| OUTLIER PORTION | Identifies the dollar amount calculated that reflects the outlier portion of the charges |

| PTPD + TEP | Pass through per discharge plus total blended payment – The sum of the pass through per discharge cost plus the total blended payment amount |

| STANDARD DAYS USED | Identifies the number of regular Medicare Part A days covered for this claim |

| LTR DAYS USED | Identifies the number of LTR days used during this benefit period |

| PROV REIMB | The amount in this field is the gross reimbursement for the DRG. If a deductible charged or if the beneficiary is in a coinsurance situation, the reimbursement amount will be reduced accordingly on the provider remittance advice. |

To access the DRG PPS Inquiry Right View, press the <F11/PF11> key.

| Field | Description |

|---|---|

|

DIAGNOSES |

Diagnosis code(s) (entered by provider) |

| POA | End of POA indicator (entered by provider) |

| PROCEDURES | Procedure code(s) (entered by provider) |

| NPI | National Provider Identifier (NPI) (entered by system) |

| SEX | Beneficiary sex (entered by provider) |

| C-I | Century indicator(entered by provider) |

| DISCHARGE STATUS | Discharge status code (entered by provider) |

| DT | Discharge date – entered by provider |

| PROV | Medicare provider number (entered by system) |

| REVIEW CODE | Indicates the code used in calculating the standard payment. Valid Values 00 = Pay with outlier – Use of this code will calculate the standard payment and will also attempt to pay only cost outliers, day outliers expired 10/1/1997. 03 = Pay per diem days – Use of this code will calculate a per diem payment based on the standard payment if the covered days are less than the average length of stay (ALOS) for the diagnosis-related group (DRG). If the covered days equal or exceed the ALOS, the standard payment is calculated and will also calculate the cost outlier portion of the payment if the adjusted charges on the bill exceed the cost threshold. 06 = Pay transfer no cost – Use of this code will pay per diem payment based on the standard payment if the covered days are less than the ALOS for the DRG. If covered days equal or exceed the ALOS, the standard payment is calculated and will not calculate any cost outlier portion of the payment. 07 = Pay without cost – Use of this code will calculate the standard payment and will also calculate the day outlier portion of the payment if the covered days exceed the outlier cutoff for the DRG. 09 = Pay transfer special DRG – Post-acute transfers for DRGs 209, 110, 211, 014, 113, 236, 263, 264, 429 and 483. Post-acute transfers will calculate a per diem payment based on the standard DRG payment if the covered days are less than the ALOS for the DRG. If covered days equal or exceed the ALOS, the standard payment is calculated and will also calculate the cost outlier portion of the payment if the adjusted charges on the bill exceed the cost threshold. |

| TOTAL CHARGES | Total charges (entered by provider) |

| DOB | Beneficiary’s date of birth (entered by provider) |

| OR AGE | Beneficiary’s age (entered by provider) |

| APPROVED LOS | Approved length of stay (entered by provider) |

| COV DAYS | Covered Medicare days (entered by provider) |

| LTRDAYS | Identifies the number of lifetime reserve days used for a particular claim |

| PAT LIAB | Patient liability due – Identifies the dollar amount owed by the beneficiary to cover any coinsurance days or noncovered days or charges |

Returned From Grouper:

| Code | Description |

|---|---|

| GROUPER VERSION | Indicates the program identification number for the Grouper program used |

| D.R.G. | Diagnosis related group – Identifies the code assigned by the CMS Grouper program using specific data from the claim (e.g., LOS, covered days, sex, age diagnosis and procedure codes, discharge date, and total charges) |

| INIT | Initial Diagnosis Related Group code assigned by the CMS grouper program using specific data from the claim, such as length of stay, covered days, sex, age, diagnosis and procedure codes, discharge date and total charges (four-digit numeric field, led by a zero [0]) |

| MAJOR DIAG CAT | Major diagnostic category – Identifies the category in which the DRG resides Valid Values 01 = Diseases and disorders of the nervous system 02 = Diseases and disorders of the eye 03 = Diseases and disorders of the ear, nose, mouth, and throat 04 = Diseases and disorders of the respiratory system 05 = Diseases and disorders of the circulatory system 06 = Diseases and disorders of the digestive system 07 = Diseases and disorders of the hepatobiliary system and pancreas 08 = Diseases and disorders of the musculoskeletal system and connective tissue 09 = Diseases and disorders of the skin, subcutaneous tissue and breast 10 = Endocrine, nutritional, and metabolic diseases and disorders 11 = Diseases and disorders of the kidney and urinary tract 12 = Diseases and disorders of the male reproductive system 13 = Diseases and disorders of the female reproductive system 14 = Pregnancy, childbirth, and the puerperium 15 = Newborns and other neonates with conditions originating in the perinatal period 16 = Diseases and disorders of the blood, blood forming organs, and immunological disorders 17 = Myeloproliferative diseases and disorders, and poorly differentiated neoplasms 18 = Infections and parasitic diseases (systemic or unspecified sites) 19 = Mental diseases and disorders 20 = Alcohol/drug use and alcohol/drug induced organic mental disorders 21 = Injuries, poisonings, and toxic effects of drugs 22 = Burns 23 = Factor influencing health status and other contacts with health services 24 = Multiple significant trauma 25 = Human immunodeficiency virus infections |

| RETURN CD: | Return code – Identifies the status of the claim when it has returned from the Grouper program |

| PROC CD USED | Identifies the ICD-10 procedure code used by the Grouper program for calculation |

| DIAG CD USED | Identifies the ICD-10 diagnosis code used by the Grouper program for calculation |

| SEC DIAG USED | Identifies the secondary ICD-10 diagnosis code used by the Grouper program for calculation |

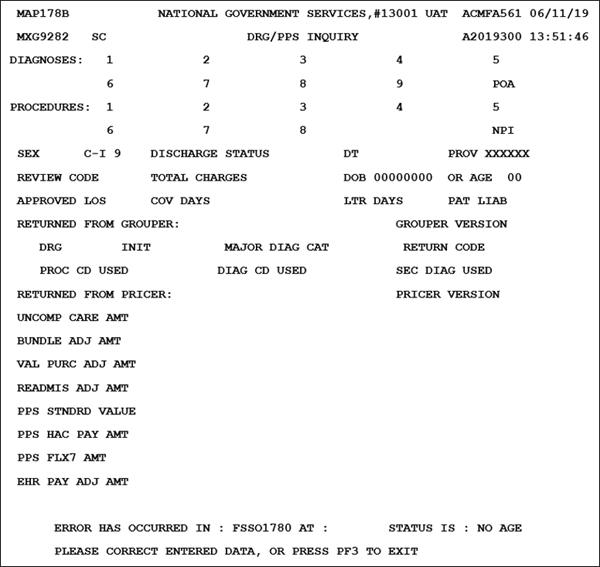

Returned From Pricer:

| Code | Description |

|---|---|

| PRICER VERSION | Identifies the program version number for the Pricer program used |

| UNCOMP CARE AMT | Uncompensated Care Payment Amount. This is the amount published by CMS to the MACs (by provider) entitled to an uncompensated care payment amount add on. The MACs enter the amount for each Federal Fiscal year begin date, 10/01, based on published information (11-digit numeric field in 9999999.99 format) |

| BUNDLE ADJ AMT | Adjustment amount for hospitals participating in the BPCI |

| VAL PURC ADJ AMT | Adjustment amount for hospitals participating in the Value Based Purchase Program (11-digit numeric field in 9999999.99 format) |

| READMIS ADJ AMT | Reduction adjustment for those hospitals participating the Hospital Readmissions Reduction program (11-digit field in 9999999.99 format) |

| PPS STNDRD VALUE | Final standardized amount. This value is returned from the IPPS Pricer for claims that meet the criteria identified in specification S0580000 (11-digit numeric field in 9999999.99 format) |

| HAC PAY AMT | HAC payment reduction amount (11-digit field in numeric 9999999.99 format) |

| PPS FLX7 AMT | Reserved for future use |

| EHR PAY ADJ AMT | Reduction adjustment amount for hospitals not meaningful users of EHR (11-digit numeric field in 9999999.99 format) |

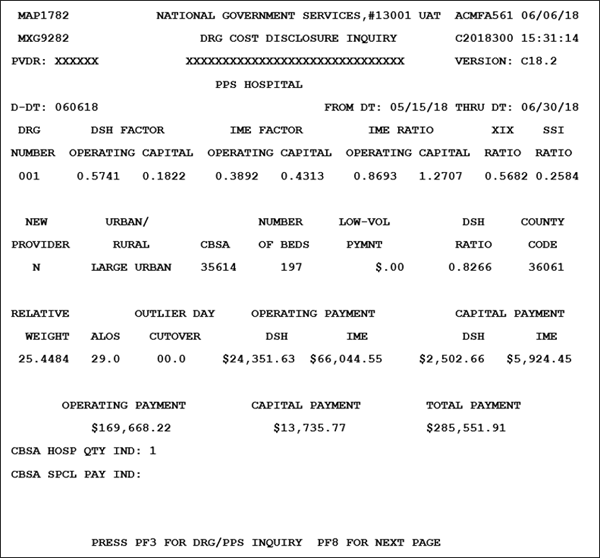

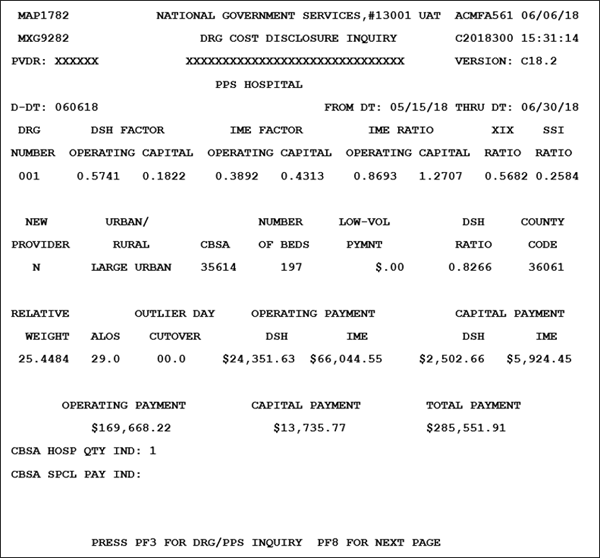

To access the DRG Cost Disclosure Inquiry Screen, press the <F8/PF8> key.

To review Cost Disclosure information, enter the following on the DRG Cost Disclosure Inquiry Screen:

- Enter the date for which the DRG information is being requested in the D-DT field.

- Date also identifies which Pricer version to obtain data from

- MMDDYY format

- Enter the DRG number from the DRG/PPS Inquiry Screen in the DRG NUMBER field.

- Identifies the program version number for the Pricer program used

- Five-digit alphanumeric field

- If left blank, DRG defaults to 001

- Press the <Enter> key.

The system will populate the following fields:

| Code | Description |

|---|---|

| PVDR | Provider – Identifies the provider number (eight-digit alphanumeric field) |

| VERSION | Provider name – Identifies the provider name (30-digit alphanumeric field) |

| D-DT | DRG date (entered by provider) |

| FROM DT | From date – Identifies the from date (eight-digit alphanumeric field in MM/DD/YY format) |

| THRU DT | Thru date – Identifies the thru date (eight-digit alphanumeric field in MM/DD/YY format) |

| DRG NUMBER | DRG Number (entered by provider) |

| DSH FACTOR OPERATING | Operating disproportionate share factor – Identifies the operating disproportionate share factor amount (five-digit field in 9.9999 format) |

| DSH FACTOR CAPITAL | Capital disproportionate share factor – Identifies the capital disproportionate share factor amount (five-digit field in 9.9999 format) |

| IME FACTOR OPERATING | Operating indirect medical education factor – Identifies the operating indirect medical education factor amount (five-digit field in 9.9999 format) |

| IME FACTOR CAPITAL | Indirect medical education factor – Identifies the capital indirect medical education factor amount (five-digit field in 9.9999 format) |

| IME RATIO OPERATING | Operating indirect medical education ratio – Identifies the operating indirect medical education ratio (five-digit field in 9.9999 format) |

| IME RATIO CAPITAL | Capital indirect medical education ratio – Identifies the capital indirect medical education ratio (five-digit field in 9.9999 format) |

| XIX RATIO | XIX ratio – Identifies the XIX ratio (five-digit field in 9.9999 format) |

| SSI RATIO | SSI ratio – Identifies the supplemental security income ratio and determines if the hospital qualifies for a disproportionate share adjustment (five-digit field in 9.9999 format) |

| NEW PROVIDER | New provider – Identifies whether or not the provider is new (one-digit alphanumeric field) Valid Values N = Not a new provider Y = New provider |

| URBAN/RURAL | Urban rural – Identifies the type of location and is determined by DRG Pricer (eleven-digit alphanumeric field) Valid Values Large urban Other urban Rural |

| CBSA | Actual geographic location core-based statistical area – Identifies the code for the CBSA '00001' '89999' or the rural area (blank, blank, blank, two-digit numeric state code) (e.g., ___36 for Ohio), where the facility is physically located (five-digit alphanumeric field) |

| NUMBER OF BEDS | Number of beds – Identifies the number of beds (six-digit field in 999999 format) |

| LOW-VOL PYMNT | Low-volume payment – amount calculated by the inpatient prospective payment systems (IPPS) Pricer is an estimated interim payment. This estimated interim low-volume payment amount will be adjusted at cost report settlement, if any of the payment amounts upon which the low-volume payment amount is based are recalculated at cost report settlement (for example payments for DSH, IME, or federal rate versus hospital-specific rate payments for sole community hospitals/Medicare dependent hospitals). |

| DSH RATIO | Disproportionate share adjustment percentage (six-digit field in 9.9999 format) |

| COUNTY CODE | County Code (five-digit numeric field) |

| RELATIVE WEIGHT | Relative weight – Identifies the relative weight amount. (six-digit field in 99.9999 format |

| ALOS | Average length of stay – Identifies the CMS-predetermined LOS based on certain claim data (three-digit field in 99.9 format) |

| OUTLIER DAY CUTOVER | Outlier day cutover – Identifies the outlier day cutover amount (three-digit field in 99.9 format) |

| OPERATING DSH | Operating payment disproportionate share – Identifies the operating payment disproportionate share amount (eight-digit field in $999,999.99 format) |

| PAYMENT IME | Operating payment indirect medical education – Identifies the operating payment indirect medical education amount (eight-digit field in $999,999.99 format) |

| CAPITAL DSH | Capital payment disproportionate share – Identifies the capital payment disproportionate share amount (eight-digit field in $999,999.99 format) |

| PAYMENT IME | Capital payment indirect medical education – Identifies the capital payment indirect medical education amount (eight-digit field in $999,999.99 format) |

| OPERATING PAYMENT | Operating payment – Identifies the total amount for operating payments (eight-digit field in $999,999.99 format) |

| CAPITAL PAYMENT | Capital payment – Identifies the total amount for capital payments (eight-digit field in $999,999.99 format) |

| TOTAL PAYMENT | Total Payment – Identifies the total amount of payments (eight-digit field in $999,999.99 format |

| CBSA HOSP QTY IND | Core-based statistical area hospital quality indicator – Identifies whether the hospital has met the criteria to receive higher payments per MMA quality standards (one position alphanumeric field) Valid Values ' ' = Quality standards have not been met 1 = Quality standards have been met Note: Displays only when the MAP178B D-DT (DRG disclosure date) is 10/01/2004 or greater |

| CBSA SPCL PAY IND: | Core-based statistical area special payment indicator – Identifies the core based statistical area special payment indicator (one-digit alphanumeric field) Valid Values ' ' = Not applicable Y = Reclassified 1 = Special wage index indicator 2 = Both special wage index indicator and reclassified Note: Displays only when the MAP178B D-DT (DRG disclosure date) is 10/01/2004 or greater |

Press the <F8/PF8> key to view the Operating Portion of the DRG Cost Disclosure Inquiry Screen.

| Code | Description |

|---|---|

| PVDR | Provider number |

| VERSION | Pricer Version Number ‒ program version number for the Pricer program used. |

| D-DT | Date for which the DRG information is being selected; which Pricer version to obtain data from, in the MMDDYY format. |

| FROM DT | From Date ‒ beginning date of service in the MM/DD/YY format. |

| THRU DT | Thru Date ‒ ending date of service in the MM/DD/YY format. |

| COST OUTLIER THRESHOLD | Cost Outlier Threshold ‒ standard operating threshold for computing cost outlier payments. |

| CASE MIX INDEX | Case Mix Index ‒ from the operating Prospective Payment System (PPS) base year |

| COST TO CHARGE RATIO | Cost to Charge Ratio ‒ ratio of operating cost to charges |

| LOW-VOL PYMNT | Low Volume Payment ‒ amount calculated by the IPPS Pricer. |

| BLEND RATIO TARGET/DRG | Blend Ratio Target/DRG ‒ ratio target amount and federal amount used during operating PPS transition periods. |

| BLEND RATIO REG/NAT | Blend Ratio Regional/National ‒ ratio of the regional amount and national amount used during the operating PPS transition periods to determine the operating federal rate. |

| TARGET AMOUNT | Target Amount ‒ updated hospital specific rate. This is used to determine HSA add-on amounts for sole community and Medicare dependents hospitals. |

| WAGE AMOUNT NATIONAL | National wage-related rate; used to determine the labor portion of the operating federal rate. |

| WAGE AMOUNT REGIONAL | Regional wage-related amount |

| NON-WAGE AMOUNT NATIONAL | National nonwage-related rate; used to determine the labor portion of the operating federal rate |

| NON-WAGE AMOUNT REGIONAL | Regional nonwage-related amount |

| WAGE AMOUNT – FED REG | Regional wage-related amount (10-digit numeric field) |

| WAGE INDEX – FED REG | Wage Index as supplied by CMS to be used for the state in which the services were provided to determine reimbursement rates for the services rendered. Information provided for Federal Regional and Federal National Wage Indexes |

| NON WAGE FED AMOUNT | Nonwage Federal Amount Information provided for Federal Regional and Federal National Non Wage Federal Amounts |

| NON WAGE FED RATIO | Non Wage Federal Ratio Information provided for Federal Regional and Federal National Non Wage Federal Ratios |

| AMOUNT | Total amount Information provided for Federal Regional and Federal National Amounts |

| TOTAL FEDERAL | Total Federal amount |

| TOTALS | Totals Information provided for Federal Regional, Federal National, Total Federal, Hospital Amount, HSA Amount |

| TOT FED | Sum of Total Federal columns |

| HOSPITAL AMOUNT | Sum of Federal Regional amounts for Amount and Totals columns |

| BLEND AMOUNT | Blended amount ‒ sum of amounts for Wage Index, Non Wage Federal Amount, Non Wage Federal Ratio, Amount, and Totals columns |

| HSA AMOUNT | HSA Amount – sum of amounts for Wage Index, Non Wage Federal Amount, Non Wage Federal Ratio, Amount, and Totals columns |

| HSA CALC | Calculation for the Health Service Area (HSA) |

| DRG WT | Diagnosis Related Group (DRG) Weight (WT) – payment weight of the DRG. |

| HSA TOT | HSA Total ‒ total of the HSA amount multiplied by the DRG Weight. |

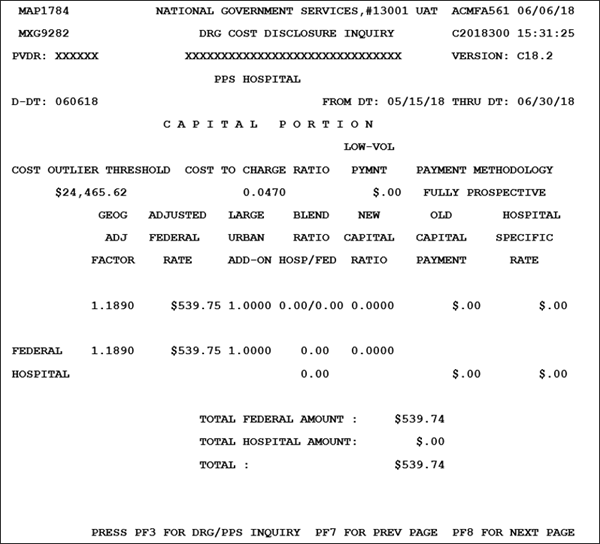

Press the <F8/PF8> key to view the Capital Portion of the DRG Cost Disclosure Inquiry Screen.

| Code | Description |

|---|---|

| PVDR | Provider number |

| VERSION | Pricer Version Number ‒ program version number for the Pricer program used. |

| D-DT | Date for which the DRG information is being selected; which Pricer version to obtain data from, in the MMDDYY format. |

| FROM DT | From Date ‒ beginning date of service in the MM/DD/YY format. |

| THRU DT | Thru Date ‒ ending date of service in the MM/DD/YY format. |

| COST OUTLIER THRESHOLD | Cost Outlier Threshold amount ‒ standard operating threshold for computing cost outlier payments. |

| COST TO CHARGE RATIO | Cost to Charge Ratio ‒ operating cost to charges. |

| LOW-VOL PYMNT | Low Volume Payment amount calculated by the IPPS Pricer. |

| PAYMENT METHODOLOGY | Payment Methodology represents the capital Prospective Payment System (PPS) payment methodology. This is a 20-digit alphanumeric field. |

| GEOG ADJ FACTOR | Geographical Adjustment Factor ‒ used to adjust the capital federal rate, based on the applicable wage index. Federal Hospital information also provided |

| ADJUSTED FEDERAL RATE | Adjusted Federal Rate ‒ base capital rate. Federal Hospital information also provided |

| LARGE URBAN ADD-ON | Large Urban Add-On ‒ federal rate applicable to those hospitals located in a ‘large urban ’ MSA. Federal Hospital information also provided |

| BLEND RATIO HOSP/FED | Blended Ratio Hospital/Federal represents the ratio of the Hospital Specific Rate (HSA) and the federal rate used to compute capital payments under PPS. Federal Hospital information also provided |

| NEW CAPTIAL RATIO | New Capital Ratio ‒ new capital to total capital; applicable for hospitals being reimbursed under the hold harmless payment method for capital. Federal Hospital information also provided |

| OLD CAPITAL PAYMENT | Old Capital Payment ‒ old capital cost per discharge as provided by the hospital or as provided by the latest filed cost report under capital PPS; applicable for those hospitals being reimbursed under the hold harmless payment method for capital. Federal Hospital information also provided |

| HOSPITAL SPECIFIC RATE | Hospital Specific Rate (HSR) ‒ capital base period cost per discharge updated to the applicable fiscal year end. Federal Hospital information also provided |

| TOTAL FEDERAL AMOUNT | Total Federal Amount |

| TOTAL HOSPITAL AMOUNT | Total Hospital Amount |

| TOTAL | Total Federal and Hospital amounts. |

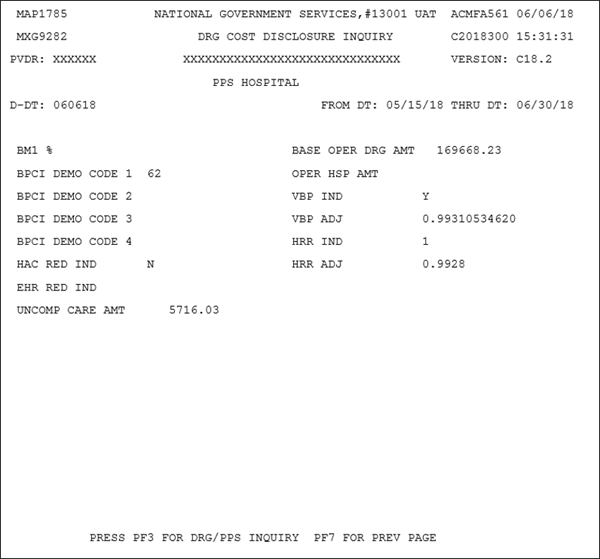

Press the <F8/PF8> key to view additional DRG/PPS information.

| Code | Description |

|---|---|

| PVDR | Provider number |

| VERSION | Pricer Version Number ‒ program version number for the Pricer program used. |

| D-DT | Date for which the DRG information is being selected; which Pricer version to obtain data from, in the MMDDYY format. |

| FROM DT | From Date ‒ beginning date of service in the MM/DD/YY format. |

| THRU DT | Thru Date ‒ ending date of service in the MM/DD/YY format. |

| BM1 % | Bundle Model 1 Discount Percentage. |

| BPCI DEMO CODE 1 | Bundled Payment for Care Improvement (BPCI) Demo Code 1 ‒ BPCI Indicator. The valid values are:

|

| BPCI DEMO CODE 2 | BPCI Demo Code 2. The valid values are:

|

| BPCI DEMO CODE 3 | BPCI Demo Code 3. The valid values are:

|

| BPCI DEMO CODE 4 | BPCI Demo Code. The valid values are:

|

| HAC RED IND | This field is reserved for future use.

|

| EHR RED IND | Electronic Health Record Adjustment Reduction Indicator: This field identifies the EHR adjustment reduction indicator for providers that are subject to claim adjustments when the provider does not meet the guidelines for use of EHR technology. This is a one-digit alphanumeric field. Valid values are:

|

| UNCOMP CARE AMT | Uncompensated Care Payment Amount: This is the amount published by CMS to the MACs (by provider) entitled to an uncompensated care payment amount add on. The MACs enter the amount for each Federal Fiscal year begin date, 10/01, based on published information. This is a ten-digit field in 9999999.99 format. |

| BASE OPER DRG AMT | Base Operating DRG Payment Amount - amount a hospital would normally receive for the discharge of a Medicare patient. |

| OPER HSP AMT | Operating Hospital Specific Payment (HSP) Amount |

| VBP IND | Value Based Pricing (VBP) Indicator (IND). The valid values are ‘Y' or 'N'. |

| VBP ADJ | Value Based Pricing Adjustment. |

| HRR IND | Hospital Readmission Reduction (HRR) Program Indicator. The valid values are '0' through '9'. |

| HRR ADJ | HRR Adjustment. |

Revised 8/16/2023